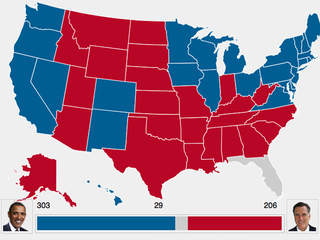

WE ARE NOW A NATION DIVIDED!

Many of you were in awe these weeks past as the election process unfolded. There are some that feel the election was rigged or other claims to a conspiracy of sorts. All these things are possible I suppose. The one certain fact is that we are a nation divided ideologically to the core. I have never seen such a chasm of beliefs and vision. I speculate this must have been the temperament of the population prior to the Civil War. We are now entering into a climate where half (population) of the country does not feel represented in beliefs about where to nation is going. This half is now wondering what is next? What event or chain of events will heal this divided UNION? In this climate, we are compelled to look towards financial safety with what you have worked hard to save. In this market Precious metals are a must if you want to have some stability in buying power and hedge against inflation.

Today, gold continues to hold its value and even soar with inflation. In times of uncertainty and geopolitical unrest, investors gravitate towards gold and other precious metals known as bullion. Physical gold, unlike stocks, ETF’s, and other paper wealth, cannot go to zero. Many professional advisers are finally advising that a properly diversified portfolio should contain 5-20% Bullion to preserve and increase one’s wealth.

GOLD IS SAFE:

Despite the political results, precious metals didn’t rally as many suspected they would. Why is this? Recently, there has been appreciation of the US Dollar against leading risk related currencies such as the Euro and Canadian dollar. During the past couple of months the Euro/USD declined by 1.2%. In addition, there were some positive reports regarding the progress of the U.S economy, the November non-farm payroll report was higher than anticipated, the manufacturing PMI continues to expand at a faster pace, and U.S GDP growth remains stable at 2% as of the third quarter of 2012.

Although the current news isn’t driving the metal through the roof, I recommend that you stay the course on your position and remain exposed to metals. The world economic climate has not changed and things will likely get worse.

- The mean average expectation of 16 analysts is that gold will close the year at $1,900 an ounce, or 9 percent more than now.

- Paulson & Co. has a $3.62 billion bet through the SPDR Gold Trust (GLD), the biggest gold-backed exchange- traded product,

- Soros Fund Management LLC increased its holdings by 49 percent in the third quarter, U.S. Securities and Exchange Commission filings show.

- 1980 record of $850 equal to $2,398 today

- Gold’s 12-year rally, the longest in at least nine decades, is poised to continue in 2013 as central banks from Europe to China are pledging more steps to boost growth, raising concern about inflation and currency devaluation.

We can probably expect gold to continue its climb in 2013-14 unless real and significant progress is made in the world’s economic situation. With current debt levels and continued failure to solve the financial debacle, a change of course is highly unlikely. The world financial authorities are simply trying their best to weather the storm.

RECOMMENDATION:

Have your position in precious metals. I recommend having 5-20% of your wealth in metals. In my opinion, you should have physical to meet the demands of an extreme emergency. In addition to physical gold, I would recommend looking in the mining sector equities for a value opportunity in a mining operation(s) that are in production.

This mining sector is where most of my efforts are currently. I believe there could be an upside to the price of metals, but I KNOW there can be an upside to mining investment in the correct companies. Please see Featured Investments for more information.